(Bloomberg) — Stocks rise as an unexpected slowdown in inflation puts an end to the Federal Reserve’s aggressive rate-hike cycle, raising expectations that its next move will be a rate cut in mid-2024. Bond yields fell.

Most Read Articles on Bloomberg

More than 95% of S&P 500 companies rose, with the gauge up 2%. Tesla Inc. led the mega-cap rally, while Nvidia Inc. extended its gains to the 10th consecutive session. Financial stocks also rose significantly, with regional banks in particular rising 7%. The small-cap Russell 2000 index rose more than 4%, the most in a year. The yield on two-year government bonds fell about 20 basis points to 4.85%. The dollar fell 1%, the most since January. Fed swaps are pricing in 50 basis points of easing in July.

Read: Wall Street gleefully says ‘we’re going to win this’: Watch

The inflation report further reinforced the “Goldilocks story” that the economy remains resilient and inflation declines, allowing the Fed to ease policy in 2024. The core consumer price index, which excludes food and energy costs, rose 0.2% from September. Economists support this measure as a better indicator of underlying inflation than the overall CPI. This measure was tempered by low gasoline prices, but little changed.

Chris Zaccarelli of Independent Advisor Alliance said it remains to be seen whether the economy can avoid a recession, but markets are moving as investors begin to accept that higher interest rates are unexpected. He said it should continue to rise.

“The last investors who aren’t convinced that Fed policy is over will likely ‘throw in the towel,'” said Bryce Doty of Sit Fixed Income Advisors. “The Fed’s next action is more likely to be a rate cut next summer than another rate hike.”

Charles Schwab UK’s Richard Flynn says falling inflation suggests recent monetary policy is working, making a “soft landing” more likely than ever. . The news made it more likely that officials would “hold back” from raising rates further, he said.

“Inflation data is a ‘soft landing nirvana’ for the stock market as the U.S. economy holds up,” said Neil Dutta, head of economics at Renaissance Macro Research.

Stocks rose in November on expectations that the Fed would finish raising interest rates, with the S&P 500 up more than 7% during the period and on track for its best month since October 2022.

Over the past 22 years, the S&P 500 has risen more than 5% through mid-November, but the rest of the year has been positive every time, according to data compiled by Bloomberg. Going back 50 years, that setting was positive 26 out of 30 times, with four exceptions where the decline was less than 1%.

“We need another month of soft inflation data, but the stock and bond markets are in a celebratory mood today,” said Gina Bolvin, president of Bolvin Wealth Management Group. “Preparations are well underway for the year-end gathering,” she said.

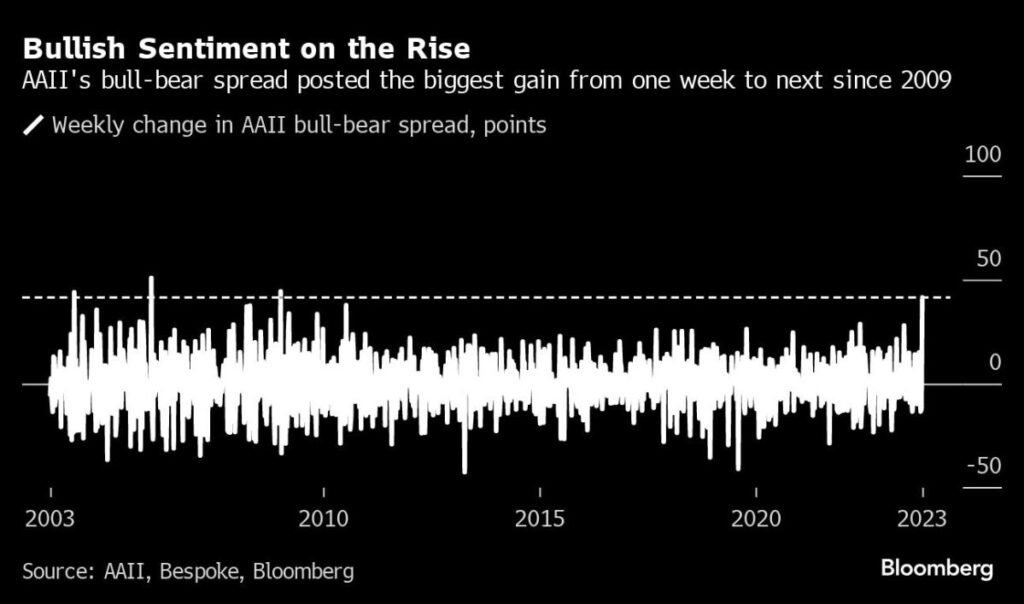

Meanwhile, a new survey of Bank of America Corp. fund managers shows there is “strong belief” that interest rates will fall in 2024, making investors the most bullish on bonds since the global financial crisis. Ta. Investors are dumping cash to maintain their biggest bond overweight positions since 2009, a poll showed.

Bond giant Pacific Investment Management Company is one of many companies whose hopes for stock gains this year have been disappointed, but is renewing its hopes for 2024.

Pimco managers Erin Brown, Geraldine Sundstrom, and Emmanuel Shalev predict that bonds will perform better than stocks today in a new report predicting the asset class’s “prime time” in 2024. “It was rarely as attractive as this.”

Traders are also keeping an eye on a number of other Fed speakers for the latest data and thoughts on how it might affect the central bank’s next steps. Richmond Fed President Thomas Barkin said despite “substantial progress” in curbing price pressures in recent months, inflation remains on a clear path toward the central bank’s 2% target. He said he was not sure there was.

Hugh Pill, chief economist at the Bank of England, also said UK interest rates needed to remain in “restrictive” territory to limit the risk of sustained inflation.

Company highlights:

Snap Inc. rose after the Information reported that Amazon.com has agreed to let users buy products directly from ads on the Snapchat app.

Home Depot has reduced its forecast for a decline in profit this year due to a decline in demand for home improvement.

Boeing increased its order book on the second day of the Dubai Air Show, winning a contract from Ethiopian Airlines for more narrow- and wide-body aircraft. Meanwhile, rival Airbus SE continues to chase the increasingly elusive Emirates contract.

Glencore has acquired a majority stake in Teck Resources’ coal business, ending months of turmoil that has gripped the mining industry and paving the way for the commodity giant to exit the coal business altogether.

Siemens Energy, which is in financial trouble after suffering huge losses in its wind turbine division, has agreed to a 15 billion euro ($16.2 billion) deal with the German government, its largest shareholder Siemens and a consortium of banks. It was concluded.

This week’s main events:

China retail sales, industrial production, fixed asset investment, Wednesday

Japan’s GDP, industrial production, Wednesday

UK CPI, Wednesday

US Retail Sales, Corporate Inventories, PPI, Empire Manufacturing, Wednesday

Wednesday’s target profit

New home prices in China Thursday

U.S. new jobless claims, industrial production, Thursday

Walmart earnings results Thursday

US President Joe Biden and Chinese President Xi Jinping are scheduled to meet at Thursday’s APEC summit

Cleveland Fed President Loretta Mester, New York Fed President John Williams and Fed Vice Chair for Supervision Michael Barr speak Thursday

Bank of England Deputy Governor Dave Ramsden and ECB President Christine Lagarde speak at Thursday’s event

U.S. housing starts Friday

Congress faces a midnight deadline Friday to pass a federal spending bill.

ECB President Christine Lagarde speaks on Friday

Chicago Fed President Austan Goolsby, Boston Fed President Susan Collins and San Francisco Fed President Mary Daly speak on Friday.

The main movements in the market are:

stock

As of 11:08 a.m. New York time, the S&P 500 was up 2%.

Nasdaq 100 rose 2.1%

The Dow Jones Industrial Average rose 1.5%.

Stoxx European 600 rose 1.4%

MSCI World Index rises 2%

currency

The Bloomberg Dollar Spot Index fell 0.9%.

The euro rose 1.4% to $1.0844.

Sterling rose 1.5% to $1.2466.

The Japanese yen rose 0.6% to 150.80 yen to the dollar.

cryptocurrency

Bitcoin fell 0.8% to $36,207.95.

Ether fell 0.8% to $2,044.4.

bond

The 10-year Treasury yield fell 18 basis points to 4.46%.

Germany’s 10-year bond yield fell 11 basis points to 2.60%.

UK 10-year bond yields fell 14 basis points to 4.17%.

merchandise

West Texas Intermediate crude rose 1.5% to $79.44 per barrel.

Spot gold rose 0.9% to $1,964.59 an ounce.

This article was produced in partnership with Bloomberg Automation.

–With assistance from Vildana Hajric, Jan-Patrick Barnert, and Allegra Catelli.

Most Read Articles on Bloomberg Businessweek

©2023 Bloomberg LP