(Bloomberg) — Stocks and U.S. stock futures are in quiet trading as investors wait for fresh momentum after a week in which the S&P 500 index hit a new record and European stocks narrowly missed that record. It was solid.

Most Read Articles on Bloomberg

S&P 500 futures rose 0.2% and Nasdaq 100 rose 0.3% as the US cash market was closed for the President’s Day holiday. Wednesday’s gains from flag-bearer Nvidia could provide fresh impetus to stock markets as investors try to gauge the strength of the global economy.

The Stoxx Europe 600 index was little changed from last week’s 1.4% rise, which brought the gauge within four points of its January 2021 high. Basic resources stocks led the decline due to a decline in iron ore, while the technology sector also underperformed. Defensive sectors such as communications and healthcare rose.

Among European stocks, AstraZeneca rose more than 3% after trial data showed its Tagrisso drug slowed disease progression in lung cancer patients. German weapons maker Rheinmetall AG rose as much as 4% after announcing it would open a new factory in Ukraine. Banco Santander SA rose after starting share buybacks.

U.S. and global stocks remain buoyed by this month’s slide in U.S. Treasuries after traders backed off aggressive bets on interest rate cuts following a series of better-than-expected economic data and hawkish rhetoric from policymakers. Not reacting. Investors will also have to contend with mixed returns, as Middle East conflict and Red Sea shipping disruption pose major risks to the profit outlook.

“While our base case remains for stocks to end the year above current levels, we don’t expect it to be a straight line,” said Mohit Kumar, chief European economist at Jefferies International. I haven’t.” A pullback is expected in the short term, providing better levels to reset long positions. ”

Swap trades currently price in about 90 basis points (bp) of the Federal Reserve’s rate cut in 2024, up from more than 150 basis points in early February. In Europe, the stake was reduced from 150 basis points to about 100 basis points.

For JPMorgan Asset Management, U.S. stocks are perfectly priced as market momentum since the start of the year has “consolidated.”

“The market is adjusting to the idea that a rate cut is on the back burner and probably less important than the initial price,” global market strategist Vincent Jubins said on Bloomberg TV. The increase was “driven by the decent revenue growth we saw in the fourth quarter,” he added.

This week, traders are keeping an eye on European inflation data as well as the earnings of Nvidia, mining giants BHP Group and Rio Tinto. Meanwhile, Qatar’s foreign minister said that negotiations aimed at securing a ceasefire and the release of hostages between Israel and Hamas have not proceeded as expected, and the conflict in the Middle East is expected to drag on.

There was no spot trading in government bonds due to the US holiday, and the bond market was quiet. Interest rates fell on Friday, with the yield on the two-year note rising 7 basis points to 4.65% as a sharp rise in service costs pushed up the producer price index. The dollar weakened against most of the Group of Ten (G10) members.

china reopens

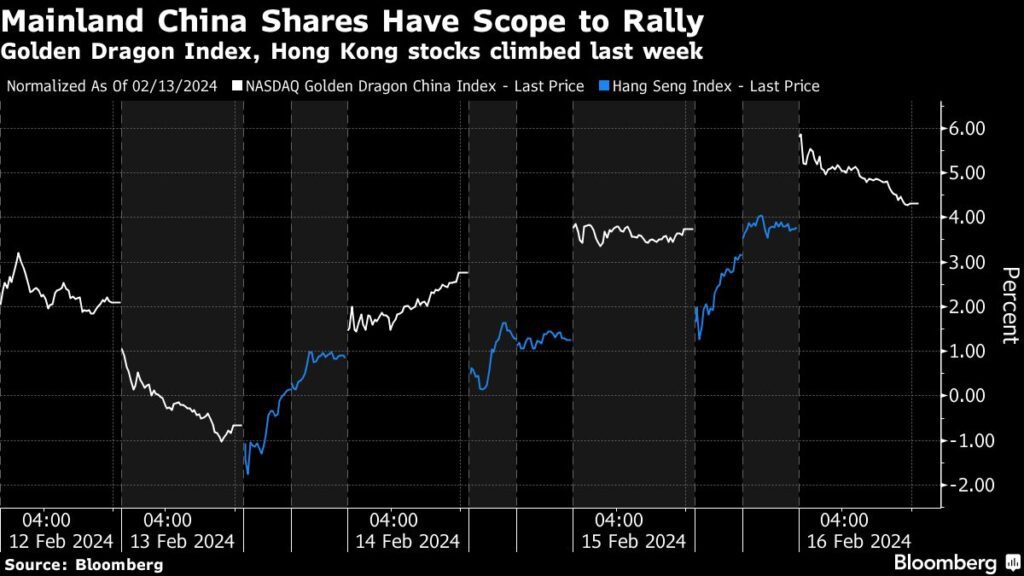

Elsewhere, Asia-Pacific stock indexes rose, with prospects set for a third session of gains. Mainland China’s benchmark CSI 300 index rebounded from earlier losses in its first day of trading after the Lunar New Year holiday. Stocks struggled early on despite strong travel and tourism data that suggests spending is picking up even as the economy as a whole struggles with deflation and a real estate crisis.

Traders are now calling for more policy support across China’s monetary and fiscal sectors, on top of the reserve requirement cuts already in place. Chinese Premier Li Qiang on Sunday called for “real and strong” action to boost public confidence in the economy.

In commodities, crude oil fell from a three-week high as concerns about the demand outlook persisted and tensions in the Middle East persisted. Gold rose for the second day in a row. Iron ore prices fell after five days of gains, partly due to concerns about the Chinese economy.

Some of this week’s main events:

Reserve Bank of Australia February Meeting Minutes, Tuesday

China loan prime rate Tuesday

BHP Group Ltd. Tuesday’s earnings

The European Central Bank releases an indicator of euro area bargained wage rates on Tuesday

Rio Tinto Plc earnings, Wednesday

Eurozone consumer confidence Wednesday

Nvidia Corp Wednesday’s earnings

US Federal Reserve Board (FRB) January Meeting Minutes, Wednesday

Atlanta Fed President Rafael Bostic speaks Wednesday

Eurozone CPI, PMI, Thursday

European Central Bank publishes report of January 25 meeting on Thursday

Fed President Lisa Cook and Minneapolis Fed President Neel Kashkar speak on Thursday

Chinese real estate prices Friday

European Central Bank Board Member Isabel Schnabel speaks on Friday

The main movements in the market are:

stock

S&P 500 futures were little changed as of 11:29 a.m. New York time.

Dow Jones Industrial Average futures little changed

The Stoxx European 600 rose 0.2% to its highest level in more than two years.

Nasdaq 100 futures rose 0.2%

The MSCI Asia-Pacific index rose 0.1%, hitting a nearly 22-month high.

MSCI Emerging Markets Index little changed

S&P/BMV IPC down 0.5%

currency

Bloomberg Dollar Spot Index little changed

The euro was almost unchanged at $1.0768.

The British pound fell 0.1% to $1.2587.

The Japanese yen was almost unchanged at 150.17 to the dollar.

The offshore yuan was almost unchanged at 7.2106 yuan to the dollar.

The Mexican peso remains almost unchanged at 17.0579 pesos per dollar.

The Brazilian real rose 0.1% to 4.9613 reais to the dollar.

cryptocurrency

bond

The 10-year government bond yield was almost unchanged at 4.28%.

German 10-year bond yield remains unchanged at 2.41%

UK 10-year bond yields were little changed at 4.11%.

merchandise

Coming soon: Sign up for the Hong Kong edition for an inside guide to the money and people rocking Asia’s financial hub.

West Texas Intermediate crude rose 0.6%, its highest since Nov. 7.

Spot gold rose 0.1% to $2,015.91 an ounce.

This article was produced in partnership with Bloomberg Automation.

–With assistance from Charlotte Yang and Tassia Sipahutar.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP