(Bloomberg) — Dovish signals from the U.S. Federal Reserve led to a massive rally that outpaced Wall Street assets on Wednesday as bond yields fell while the S&P 500 index neared record highs. I was given even more support.

Most Read Articles on Bloomberg

Traders welcomed the Fed’s “dot plot” adjustment, with officials expecting a 75 basis point rate cut next year, a faster pace than the rate cut indicated in September. The S&P 500 index rose about 1.5%, topping 4,700. The Dow Jones Industrial Average hit an all-time high. The two-year bond yield fell 30 basis points (bp) to about 4.4%, its lowest level since March. The dollar fell to its lowest level since August. The swap contract shows it is betting on 140 basis points of easing over the next 12 months.

In what was perhaps the Fed’s most important decision of 2023, Chairman Jerome Powell reiterated that policy has moved largely into the restrictive realm, while easing inflation without a spike in unemployment is good news. He said that. In a move hailed as “sensible” by several market participants, the Fed chairman went on to say that inflation may have eased but is still too high and officials are proceeding with caution.

“Jerome Powell appears to be done stealing the punch bowl,” said David Russell, global head of market strategy at TradeStation. “Traders had expected the announcement to raise alarm, but it turned out to be more dovish as the Fed acknowledged that inflation had eased. This is a major change in the wording that indicates that the company believes that it is low.

Preliminary results from the Instant Market Live Pulse survey conducted after the Fed’s decision showed the S&P 500 index to rise to 4,877 by the end of next year. This is a more bullish view than reflected in the previous survey before the meeting, where investors had expected the benchmark to rise to 4,808. Still, about 51% of the 171 respondents said the current market rate cuts are too strong.

Other comments:

“The story in the investor community has shifted significantly from predicting the last Fed rate hike to predicting the first Fed rate cut. Most of the work has been done through economic forecast updates, including dot plots, but Chairman Powell certainly set a dovish tone at this meeting. The reality is that the Fed’s prescription for reining in inflation is working, and the Fed is currently targeting the current federal funds rate by 2024. “We view this as too restrictive for the country’s economy.”

“The third time is attractive because the Fed has held off on raising interest rates for the third time in a row, giving investors full confidence that the Fed is done raising rates this quarter.” Additionally, from the minutes: The emerging dovish tone of a 75 basis point rate cut not only signals that the Fed is declaring victory on inflation, but also sets the stage for Powell and his team to put the economy on a soft landing. ing. ”

“The market is celebrating the Fed’s dot moving closer to the market’s dot. This isn’t just a decision to hold current interest rates; it’s a compliment to the economy, which appears to be in line with the Fed’s long-term goals. ”

“They agreed with this statement and they agreed with this prediction, but this is as dovish as we expected. This is more than I expected in terms of dovishness. Thing”

“The FOMC statement and new economic forecast summary are dovish and risk-on, and the statement includes new language that assesses that “inflation has eased over the past year” and cuts the median forecast for next year by 3. .”

“A more dovish Fed should support risk assets as well as the fixed income asset class in 2024. There remains a risk that the Fed will need to cut rates at a slower pace than the market is pricing in. It exists and it’s real.” It will need to go beyond today’s meeting. ”

“We believe the Fed can have a soft landing in the bag. Clearly, the market believes that now. Fed members are currently looking at several rate cuts in 2024, which could also be a celebratory rate cut.” No one has a crystal ball, so it’s important to be nimble and keep in mind that interest rates may remain high for some time. However, given the Fed’s stance, The rate cut trade could continue until the end of the year.”

“The Fed gave markets an early holiday gift today, finally making their first positive comment on inflation. Their admission that inflation is coming down suggests a turning point is in sight. . It appears the Fed is moving towards the market, rather than the market moving towards the Fed. The Santa Claus rallies may continue.”

“Inflation is certainly moving in the right direction, but the Fed maintained its hawkish tone in today’s statement even as it expects three rate cuts next year. The Fed has been waiting a long time for policy to start slowing the economy and reining in inflation, and it won’t let its guard down just because the finish line is finally in sight.”

The decision comes after data shows producer price increases will slow as energy costs fall. Consumer prices on Tuesday highlighted a decline in annual inflation despite an increase in monthly increases. Taken together, these numbers support the view that inflation is on track to recover toward the Fed’s goal.

Earlier Wednesday, Treasury Secretary Janet Yellen said it makes sense for the Fed to consider lowering rates to smooth out the economy as inflation eases.

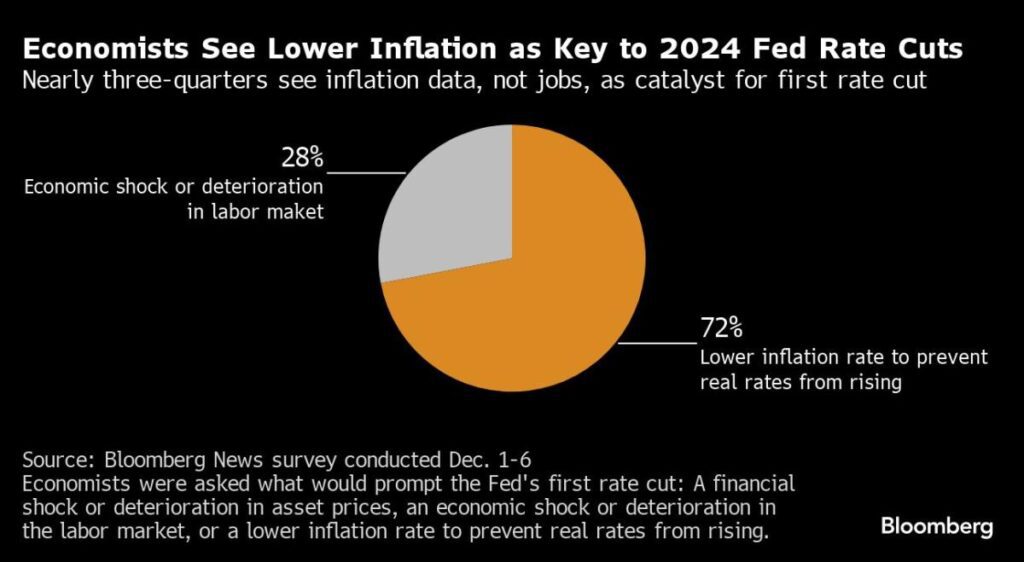

“In some ways, it’s natural that as inflation declines, interest rates would come down a little bit, because otherwise real interest rates would tend to rise and financial conditions would tighten,” Yellen said in an interview with CNBC on Wednesday. ” he said.

Company highlights:

Apple Inc. will be subject to a ban and potential steep fines for the App Store rules governing music streaming rivals in the European Union’s latest attempt to limit Big Tech’s power.

Tesla Inc. is recalling more than 2 million vehicles in the company’s largest-ever history after U.S. auto safety regulators determined that its Autopilot driver-assistance system was not sufficient to prevent abuse. I’m planning on repairing it.

SpaceX plans to sell insider shares for $97 a share in a tender offer that would push the value of Elon Musk’s space and satellite company to nearly $180 billion, according to people familiar with the matter. It will be done.

Pfizer’s disappointing forecast for next year showed that acquisitions of the leading cancer drug maker alone will not be enough to fill the ever-widening hole in its struggling coronavirus franchise.

Southwest Airlines raised its fourth-quarter earnings forecast, boosted by better-than-expected holiday travel demand and ticket prices.

Exxon Mobil has introduced a new compensation policy that pays some traders cash bonuses, a major change within the U.S. energy giant as it looks to expand its trading operations.

Coinbase Global Inc. is rolling out cryptocurrency spot trading on its international exchanges as part of its global expansion, saying some users are wary of U.S. venues due to the uncertain regulatory background. There is.

This week’s main events:

Press conference with ECB President Christine Lagarde following the European Central Bank Policy Meeting on Thursday

Bank of England Policy Meeting, Thursday

Swiss National Bank Policy Meeting, Thursday

U.S. new jobless claims, retail sales, business inventories, Thursday

China’s 1-year MLF rate and volume, real estate prices, retail sales, industrial production, unemployment rate, Friday

Eurozone S&P Global Manufacturing PMI, S&P Global Services PMI, Friday

US Industrial Production, Empire Manufacturing, S&P Global US Manufacturing PMI, Friday

The main movements in the market are:

stock

As of 4:02 p.m. New York time, the S&P 500 was up 1.4%.

Nasdaq 100 rose 1.3%

The Dow Jones Industrial Average rose 1.4%.

MSCI World Index rose 1.2%

currency

The Bloomberg Dollar Spot Index fell 0.8%.

The euro rose 0.8% to $1.0881.

Sterling rose 0.5% to $1.2628.

The Japanese yen rose 1.7% to 142.99 yen to the dollar.

cryptocurrency

Bitcoin rose 4.1% to $42,791.05

Ether rose 3.9% to $2,257.6

bond

The 10-year Treasury yield fell 18 basis points to 4.02%.

Germany’s 10-year bond yield fell 5 basis points to 2.17%.

The UK 10-year bond yield fell 14 basis points to 3.83%.

merchandise

West Texas Intermediate crude rose 1.8% to $69.83 per barrel.

Spot gold rose 2.2% to $2,022.49 an ounce.

This article was produced in partnership with Bloomberg Automation.

–With assistance from Vildana Hajric and Kasia Klimasinska.

Most Read Articles on Bloomberg Businessweek

©2023 Bloomberg LP