This is interesting in a central banking sense.

Written by Wolf Richter of Wolf Street.

In a press release today at 7pm ET, the Federal Reserve announced that the Bank Term Financing Program (BTFP), the infamous tool for dealing with the March 2023 Bank Panic and Bank Liquidity Crisis, will be delivered to banks as scheduled. It has been confirmed that new loans will be suspended. Existing loans can continue for up to one year. This decision was announced on January 9th during a panel discussion by Michael Barr, the Fed’s vice chairman for oversight.

What’s new and interesting is that the Fed also said “effective immediately” that it would halt arbitrage operations in which banks have been using BTFP to make additional money. We have been discussing this BTFP arbitrage for a while, including charts. Everything was a big fuss.

BTFP was hastily conceived over a weekend in March 2023 and announced on Sunday after two local banks, Silicon Valley Bank and Signature Bank, failed and were suspended by regulators on Friday. – Full-blown financial crisis.

However, BTFP had a fatal flaw. Under certain conditions, the interest rate the Fed charges on BTFP loans (which is market-based) could be significantly lower than the rate the Fed pays on reserve balances (which is set by the Fed). this rate).

And that’s exactly what has happened since early November during the rate cut mania. This opened up noisy, risk-free arbitrage opportunities for banks to take advantage of.

Today, the Fed made good on the deal, halting arbitrage on new loans “for future extensions through the program’s expiration date.” The press release states that the borrowing rate on BTFPs will “not be lower” than the reserve deposit rate. And this change makes arbitrage unprofitable for new loans. press release:

“Upon program termination, the interest rate applicable to new BTFP loans will be adjusted to ensure that the interest rate on new loans extended until the end of the program is no less than the interest rate on the reserve balance in effect on the date the loan is made. it was done.” .

“This interest rate adjustment ensures that BTFP continues to support its program objectives even in the current interest rate environment. This change is effective immediately. All other terms of the program remain unchanged. .”

In the new BTFP term sheet published today that applies to new loans, the interest calculation paragraph reads as follows (new wording marked in bold: IORB = Interest on Reserve Balance).

“The term prepayment rate is the overnight index swap rate for one year plus 10 basis points.” point, However, the rate cannot be lower than the IORB rate in effect on that day. Advance payment will be made. Rates are fixed on the date of prepayment. Had made.

When the Fed worker bees worked out the terms of the BTFP over the weekend (eating pizza, sleeping on the floor?), they realized that the market-based rate at which the BTFP could be borrowed, the 1-year overnight rate, might not apply. I had overlooked it. The index swap rate plus 10 basis points could be significantly lower than the Fed-set interest rate that banks earn on their reserve balances.

As of March 2023, the interest rate on BTFP was close to the interest rate paid by the Fed on its reserves. But during the rate-cutting mania that began in early November, yields on U.S. Treasuries one-year and beyond plummeted, and associated yields also fell at the same time. By mid-December, banks will be able to borrow at BTFP rates below 4.8% and then leave the cash in reserve accounts at the Fed, earning an interest rate of 5.40%. Earn money for free with no risk or effort.

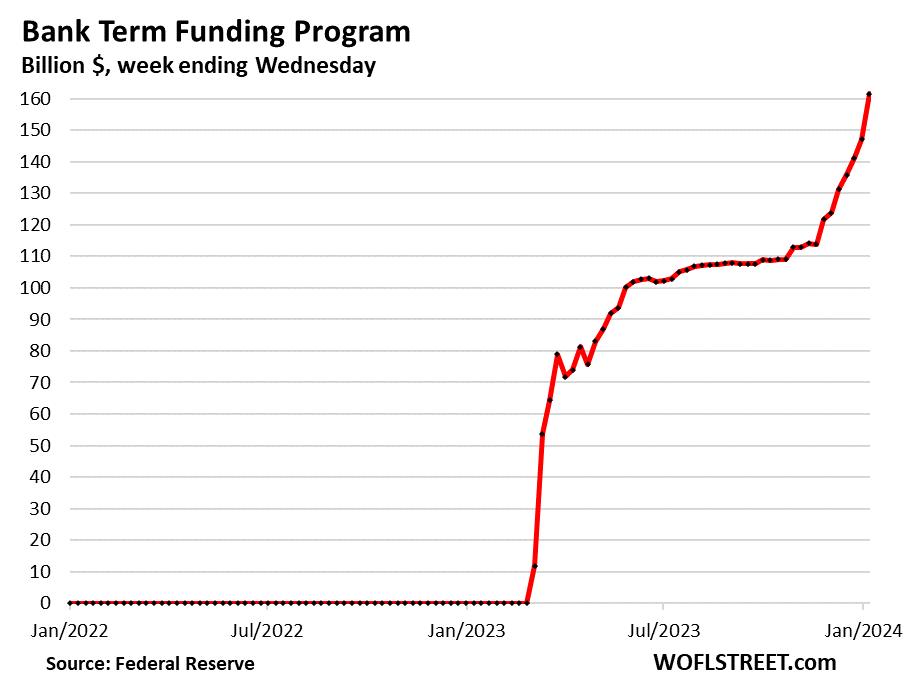

From July to October, the BTFP balance was approximately $110 billion. However, the number started to increase rapidly in early November. It soared by $14 billion last week. Since Nov. 1, it has increased by nearly 50%, or $52 billion, to $161 billion.

The Federal Reserve is expected to release new figures for the period through Wednesday on Thursday, and balances could rise again. However, this should be the last increase in his BTFP balance, as the door to making money in this circus is effectively closed.

Enjoy reading and supporting Wolf Street? You can donate. I appreciate it very much. Click on the beer and iced tea mugs to see how:

Would you like to receive email notifications when new articles are published on WOLFSTREET? Sign up here.

![]()