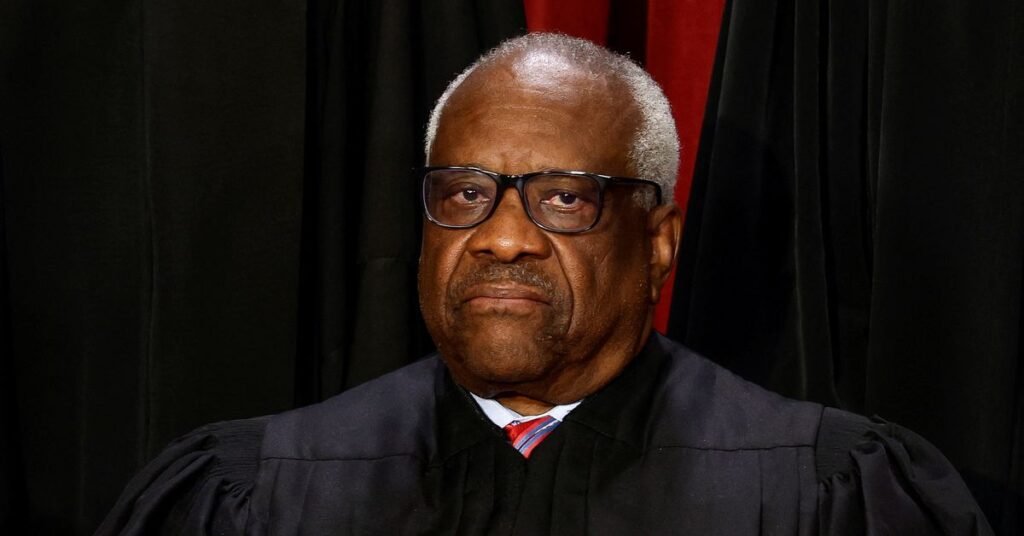

[1/2]U.S. Supreme Court Associate Justice Clarence Thomas poses during a group portrait at the Supreme Court in Washington, U.S., October 7, 2022. REUTERS/Evelyn Hochstein/File Photo Obtaining license rights

WASHINGTON, Oct 26 (Reuters) – U.S. Supreme Court Justice Clarence Thomas has ruled on new findings that the company appears to have failed to repay at least a “substantial portion” of a $267,230 loan it received from a wealthy benefactor. In response, Senate Democrats stepped up their criticism of the law Thursday. Courts have no code of ethics.

Mr. Thomas purchased the Prevost Marathon motorcoach from longtime friend Anthony Welters in 1999, according to a Wednesday report by Senate Democrats based on a review of loan documents provided by Mr. Welters. The personal loan he received was forgiven before the principal was fully repaid.

Democratic Senate Judiciary Committee Chairman Dick Durbin said in a social media post on Thursday: “With each new report, the American people wonder how much money Judge Thomas has made from a bunch of sycophantic billionaires. “I am aware that I received a lavish, private gift,” he wrote in a social media post.

Durbin said the “privately forgiven” loans demonstrate the need for a code of conduct that is binding on courts.

Thomas is part of the court’s 6-3 conservative majority and has faced criticism from Democrats this year amid revelations about some justices’ private jet trips, lavish vacations and real estate deals with the rich and powerful. has become the focus of

The latest issues involving the luxury bus came under scrutiny by Democrats on the Senate Finance Committee after the New York Times published an article about the loan in August.

The commission released its findings on Wednesday, concluding that there was no documentation showing that Mr. Thomas “ever paid Mr. Welters more than the annual interest rate on the loan.” Documents show that Mr. Welters waived his loan in 2008, according to the findings.

Finance Committee Chairman Ron Wyden will explain to Thomas “exactly how much debt was forgiven” and whether he reported the loan forgiveness on his tax return and paid all the taxes he owed. I asked. The findings also say Mr. Thomas failed to report “forgiven debt” on his 2008 financial disclosure form, which requires “debt forgiveness” to be included as income.

“The loan was never forgiven and any suggestion to the contrary is false,” Thomas’ lawyer Elliot Burke said in a statement. I went,” he said. Mr. Burke did not respond to further questions about whether the loan principal had been paid in full.

In July, the Senate Judiciary Committee approved a Democratic-backed bill that would require binding ethics rules for judges. Given Republican opposition, the bill has little chance of passing.

Mr. Thomas and Mr. Welters did not respond to requests for comment.

Unlike other federal judicial officers, life judges have no binding code of conduct, but are subject to certain financial disclosure laws.

News outlet ProPublica reported earlier this year that Thomas failed to disclose luxury travel and real estate deals involving Texas businessman Harlan Crowe.

Mr. Thomas has previously defended the omission of Crow-funded luxury travel from disclosure documents, believing it was a “personal hospitality” and exempt from disclosure requirements, and argued that he was negligent in not disclosing real estate transactions. did.

Stephen Lubet, a legal ethics expert who teaches law at Northwestern University, said Thomas’ failure to disclose the coach loan was “more serious than any previous failure.”

“This time there is not even a plausible excuse,” Lebet said. “The instructions couldn’t be clearer. It’s $250,000. It’s hard to attribute this to inattention.”

Stephen Gillers, a legal ethics expert who teaches law at New York University, added: “Thomas’s vote could send someone to life in prison for violating the law or financially ruin them.” “Yet he continues to violate the law with the confidence that it will not affect him.”

Reporting by Andrew Chan in New York and John Kruzel in Washington.Editing: Will Dunham

Our standards: Thomson Reuters Trust Principles.