- Wedbush’s Dan Ives said Apple’s recently announced efforts to develop home robots could be a setback for the company.

- He said leaning into artificial intelligence is a priority for the company.

- “If they go after robots, it’s going to be a black eye for Apple,” Ives told CNBC this week.

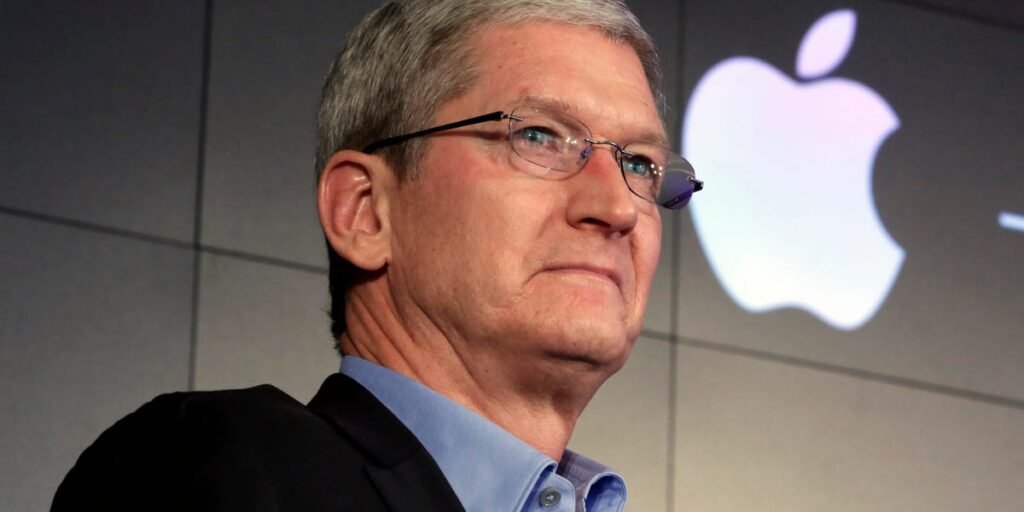

Wedbush analyst Dan Ives says Apple’s recently announced foray into home robot development could be a “horror show” for the company.

talk to CNBC This week, Ives noted: Bloomberg reporting Apple is reportedly considering developing a robot for the home, with the aim of making it the tech giant’s “next big thing.” The news comes shortly after the iPhone maker scrapped his 10-year project to commercialize self-driving cars, known as “Project Titan.”

Ives believes that such changes would be detrimental to Apple, and that the company should instead focus primarily on leaning into artificial intelligence.

“It would be scary if they actually put money into robots. Look at Project Titan, the failed EV initiative,” Ives said. “For Mr. Cook, his legacy will be AI. It would be a sore moment for Apple if they pursue robots.”

Other Wall Street strategists also question Apple’s robot development. Gene Munster, who has been bullish on the iPhone maker for years, noted that the company has shelved many projects over the years before making them available to the public.

“I 100% agree that it makes sense for Apple to have a small Skunk Works project that explores home automation more deeply. That said, the chances of seeing a product in the next five years are slim to none. ,” Munster said in the article.be post With X.

Apple has faced a number of negative headwinds and headlines over the past year, stemming from regulations in China, an antitrust lawsuit from the Department of Justice, and recent layoffs. The company’s stock price has fallen 12% from its early 2024 level.

Amid concerns about Apple’s home robots, Ives We remain bullish on the company’s stock price trajectory. In the medium term. In Wedbush’s latest note on Apple, the company maintained an “outperform” rating on the stock and a 12-month price target of $250, implying a 47% upside for the stock. But that prediction hinges on whether Apple continues to put its AI at the forefront of its priorities, analysts suggested.

“We’ve seen Apple with its back against the wall before, but this period is just another chapter in Apple’s growth story and we’re on the verge of AI coming to Cupertino.” “I’m thinking about it,” the memo said.