(Bloomberg) — Stocks finished a strong quarter on expectations that the Federal Reserve has achieved a soft landing and will continue to give a boost to American companies.

Most Read Articles on Bloomberg

Wall Street traders pushed the S&P 500 index to its 22nd record of the year after data showed the economy was in good shape, the latest to strengthen the view that officials are in no hurry to cut interest rates. offset the fedospeak. The $4 trillion increase in the value of U.S. stocks in just three months has astounded prognosticators and left many Wall Street strategists eager to update their 2024 targets.

“We believe that the market’s view of where the economic fundamentals are going, rather than the views of any particular economist or strategist, ultimately determines stock market pricing,” said RBC Capital Markets’ Lori Carbasina. “

Shares rose modestly on Thursday after struggling to find direction for much of the session. Investors digested Fed Chairman Christopher Waller’s comment that he would like to see “improvement in inflation data for at least a few months” before cutting interest rates. Traders were also reluctant to make big bets on Friday when markets close ahead of the Fed’s preferred inflation indicator and Chairman Jerome Powell’s remarks on Friday.

The S&P 500 rose to 5,254.35, ending the first quarter with a gain of more than 10%. Stock benchmarks have posted double-digit gains for two consecutive quarters only five times since 1950, according to data compiled by Bloomberg.

The two-year bond yield rose 5 basis points to 4.62%. The bond market closed at 2pm New York time. The dollar rose quarterly.

“Rightly or wrongly, unless inflation continues to rise and the labor market appears to be contributing significantly to the rise, we’re looking at a rate cut in June,” said Chris Larkin of Morgan Stanley’s E-Trade. “Our expectations will probably remain the same.”

In economic data, the government’s two main activity indicators, gross domestic product (GDP) and personal consumption expenditure, showed strong growth at the end of last year. Consumer sentiment rose markedly towards the end of March, supported by strong stock market gains and expectations that inflation will continue to ease.

Chris Zaccarelli of the Independent Advisor Alliance said a strong economy driven by resilient consumers is paving the way for another strong earnings season starting next month.

“Those who still hold on to the idea that the much-anticipated 2023 recession is just around the corner are missing out on a great 15 (if not 17) months in the stock market. “That’s what happened,” Zacarelli said.

The S&P 500 index will end the year at 5,300 as the consensus estimate for U.S. real GDP showed positive signs for stocks, according to RBC Capital Markets’ Calvasina, who raised his target from 5,150. It turns out.

The S&P 500 has passed this year’s milestone, despite some concerns that the market may become too overheated in the wake of the rally. However, with its current “undefeated” record, technical indicators suggest that its momentum is not slowing down anytime soon.

The relative strength index, a benchmark gauge that measures price momentum, ended 100 consecutive trading sessions with values above 50 as of Wednesday’s close, according to data compiled by SentimenTrader. According to the analysis, the S&P 500 Index rose each time over the subsequent two-month, three-month, six-month, and 12-month periods after exhibiting similar price momentum strength.

“Don’t buck the trend for now,” Dunn said, “but inflation remains stubborn, macro uncertainty remains high, and stock markets are set for a potentially volatile election season.” “The stretch (overbought) situation continues, so at least keep an eye on the exit.” Janie Montgomery Scott’s Wantrowski.

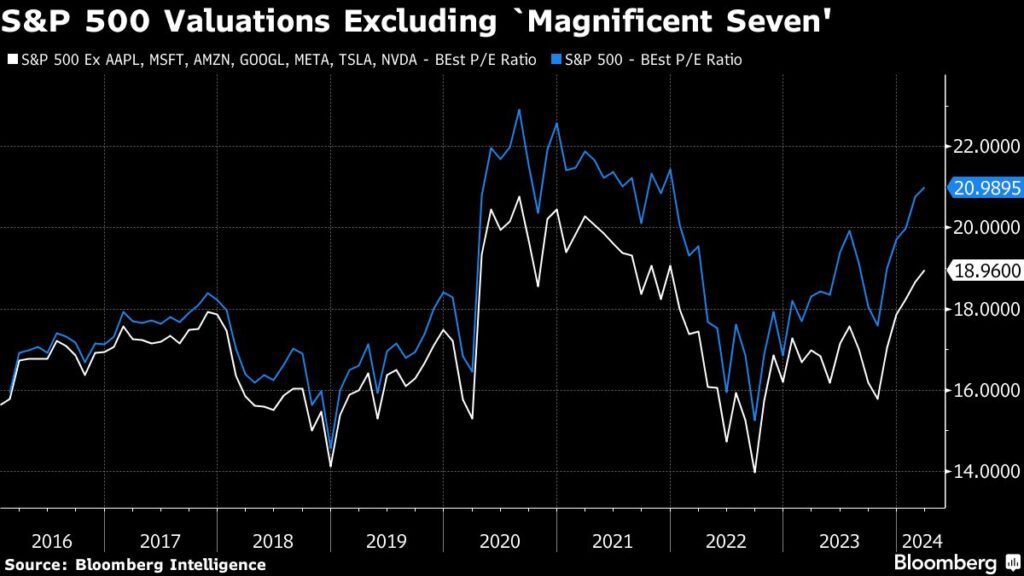

The valuation of the equal-weighted S&P 500 has risen to 17 times earnings, according to Goldman Sachs Group, but the index could continue to rise even though it has traded above its fair value in the past. It is said that it shows. Strategists led by Ryan Hammond.

“For investors concerned about overvaluation and risks to the economic outlook, our options strategists note that downside protection is attractively priced,” the strategists wrote.

After posting two consecutive quarters of double-digit percentage gains since World War II, Bespoke Investment Group noted that there was a slight slump in the following month, and a year later the gauge had risen an average of 12.27%. did.

“I wouldn’t be surprised if the stock market recedes in the near term, but history would suggest it’s too early for the stock market to decline,” said Ryan Grabinski of Strategas Securities. Ta.

Grabinski looked back at the past five months, when the S&P 500 index also rose about 27%. Out of 130 observations, he found only one with a negative return after 12 months.

Company highlights:

Apple’s overseas suppliers are ramping up production of the company’s long-awaited new iPad, with a release scheduled for early May, people familiar with the matter said.

Home Depot told investors it expects to take on $12.5 billion in debt to fund its planned acquisition of building materials distributor SRS Distribution.

Walgreens Boots Alliance has downgraded its outlook for fiscal 2024, citing a difficult retail environment including a decline in consumer spending.

B. Riley Financial Co., a blue-chip investment bank facing questions about its dealings with a former business partner, has won extra time to provide missing financial data to lenders.

Palantir Technologies has been put up for sale by Mones Crespi Hart & Co., citing a “horribly high” valuation.

Estée Lauder has raised a buy on Bank of America Corp. as the company’s profits have bottomed out.

Country Garden Holdings, China’s biggest property developer, has warned it will miss a deadline to report its annual financial results, further complicating its debt restructuring plan after defaulting on its debt last year.

This week’s main events:

Good Friday. Exchanges in the United States and many other countries were closed due to public holidays. The US federal government is open.

US Personal Income and Expenditures, PCE Deflator, Friday

San Francisco Fed President Mary Daly speaks on Friday

Federal Reserve Chairman Jerome Powell speaks on Friday

The main movements in the market are:

stock

As of 4 p.m. New York time, the S&P 500 was up 0.1%.

Nasdaq 100 fell 0.1%

The Dow Jones Industrial Average rose 0.1%.

MSCI World Index little changed

currency

Bloomberg Dollar Spot Index rose 0.1%

The euro fell 0.4% to $1.0788.

The British pound fell 0.2% to $1.2621.

The Japanese yen was almost unchanged at 151.39 to the dollar.

cryptocurrency

Bitcoin rose 2.9% to $70,872.76

Ether rose 1.6% to $3,565.65

bond

The 10-year Treasury yield rose 1 basis point to 4.20%.

German 10-year bond yield remains unchanged at 2.30%

The UK 10-year bond yield was little changed at 3.93%.

merchandise

West Texas Intermediate crude rose 2% to $82.99 per barrel.

Spot gold rose 1.2% to $2,221.19 an ounce.

This article was produced in partnership with Bloomberg Automation.

–With assistance from Esha Dey and Jessica Menton.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP