In one of many ultimate acts of his inauguration, former Prime Minister Justin Trudeau’s authorities determined to offer Canadians a break on the financial institution.

Based on a county order dated March 12, two days earlier than Trudeau resigned, banks is not going to be allowed to cost greater than $10 if they don’t have sufficient cash to cowl checks or pre-authorized debits.

Most banks cost unfair funds (NSF) charges of between $45 and $48 per transaction if the account holder doesn’t have overdraft safety. This often comes with its personal month-to-month payment.

Banks may also be prohibited from charging a number of NSF charges inside two enterprise days, and will probably be prohibited if overdraft is lower than $10.

To keep away from by accident incurring the checking account holders of NSF charges, the financial institution should additionally ship an account holder that may give an alert to offer you not less than three hours of notification that your cost is exceeding your financial institution steadiness. If the account holder deposits cash to cowl funds inside that interval, the financial institution can not cost the payment.

The brand new rules apply to people and joint accounts, however to not company or enterprise accounts. They may come into impact on March 12, 2026.

The federal government predicts the measure will cut back the NSF charges charged by the Financial institution of Canada by $4.1 billion over a decade.

Finance spokesman Marie France Faucer stated the order comes on the finish of the method that started with a 2023 information launch and a 2024 funds and a 2024 fall financial assertion.

“The work concerned in depth consultations with client teams and banks to make sure that rules present satisfactory safety for shoppers whereas technically implementable,” Faucher wrote in an e mail response.

The Canadian Banks Affiliation, which defended NSF charges to the federal government, says its members will adjust to the brand new guidelines.

“Now that NSF payment rules have been finalised by the Treasury, the financial institution’s efforts will concentrate on making adjustments to the methods and processes essential to comply,” stated Maggie Chen, media relations supervisor for the affiliation.

Based on Cheung, cost charges above the financial institution steadiness may be helpful for the Canadian banking system and there are methods to keep away from them.

“NSF charges assist promote accountable banking actions and keep the integrity of the cost system,” she responded through e mail. “To keep away from these charges, prospects can often monitor their account balances, set steadiness alerts, and think about overdraft safety providers.”

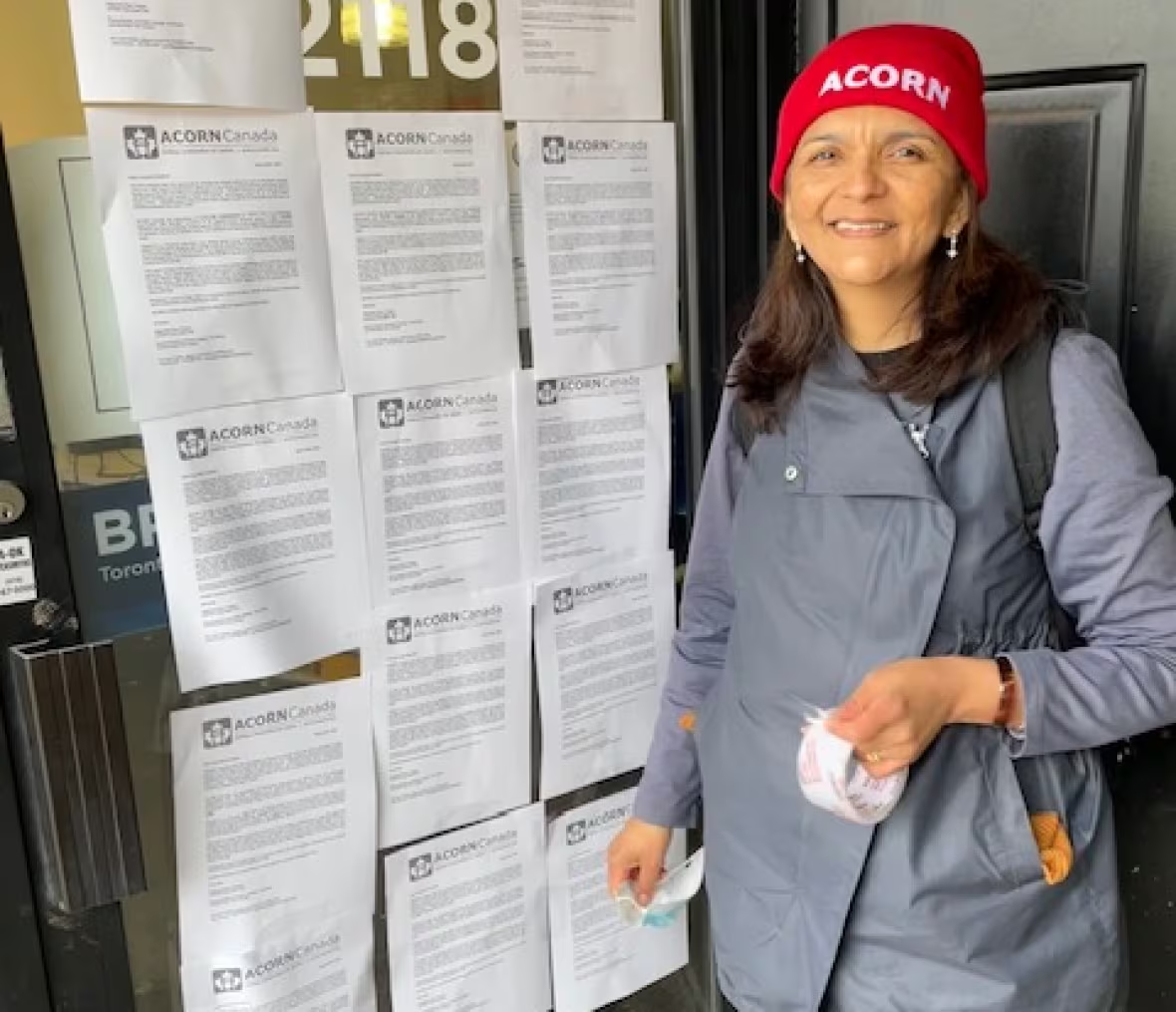

Acorn Canada President Alejandra Ruiz Vargas claims that NSF charges had been hit by disproportionately low-income Canadians, and is worked up that the federal government in the end acted on that promise.

“We’re past the moon,” she stated in an interview.

“That is one thing we have labored for a very long time. Lastly, the federal government has been listening to our issues.”

Vargas stated that even when somebody is brief on $5 to pay the invoice or cowl the verify, they will nonetheless attain $48, the cash they might use for groceries and medicines.

“It is a window of hope for folks,” she stated of the change.

Vargas stated Acorn wished the federal government to ban NSF charges and allow the adjustments quicker.

Nonetheless, in a 24-page regulatory affect evaluation despatched to Acorn, the finance division said that it had chosen a $10 cap for causes.

“The $10 cap has been chosen to steadiness the necessity to shield shoppers from excessive charges and keep the integrity of their cost system by encouraging shoppers to respect funds,” the division wrote.

The finance division estimates that in 2023, Canadian banks charged charges for NSF transactions of 15.8 million, reaching an estimated 34% of Canadians.

The valuation states that NSF charges “symbolize the supply of monetary difficulties for shoppers. These charges disproportionately hurt low-income Canadians and contribute to the debt cycle.”

These charges might quickly accumulate “on account of a decline in a number of funds,” he stated, with the brand new rules “prone to disproportionately benefiting girls, lonely dad or mum households, current immigrants and Indigenous peoples.”

Whereas some banks supply account holders grace durations, flexibility, or overdraft safety to cowl funds, not all prospects are allowed overdraft safety, the ranking factors out.

The Treasury stated the brand new rules will apply to 79 monetary establishments throughout Canada.

Particulars of the brand new rules will probably be revealed within the Canadian Official Gazette on March twenty sixth.